Best Beard Trimmers? Expert Recommendations for Grooming Equipment Companies

The beard grooming industry has experienced remarkable growth over the past decade, transforming from a niche market into a multi-billion-dollar enterprise. Professional-grade beard trimmers have become essential tools for barbershops, salons, and personal grooming enthusiasts worldwide. Whether you’re evaluating equipment for a startup beard equipment company or upgrading your existing inventory, understanding the landscape of premium trimmer manufacturers is critical to business success.

The competitive dynamics within beard equipment manufacturing require strategic decision-making around product selection, supplier relationships, and market positioning. This comprehensive guide examines the leading beard trimmer manufacturers, evaluates their technological innovations, and provides actionable insights for businesses operating in the grooming equipment sector. We’ll explore how established brands maintain market dominance while emerging competitors disrupt traditional distribution channels.

Understanding the Beard Trimmer Market Landscape

The global beard grooming equipment market reflects shifting consumer preferences toward personal grooming and professional barbering services. According to McKinsey & Company research, the men’s grooming category has consistently outpaced overall personal care growth, with beard maintenance products and equipment leading this expansion. This trend creates substantial opportunities for beard equipment companies seeking to establish market presence or expand existing operations.

Market segmentation within beard trimmer categories reveals distinct customer profiles: professional barbers requiring heavy-duty equipment, salon chains managing multiple stations, and affluent consumers investing in premium home grooming solutions. Each segment demands different specifications, pricing models, and support infrastructure. Understanding these nuances directly impacts inventory decisions, marketing strategies, and revenue projections for businesses in this space.

The competitive intensity has increased dramatically as major personal care conglomerates acquire independent grooming brands. This consolidation trend affects pricing power, distribution access, and innovation investment levels across the industry. Smaller, specialized manufacturers increasingly compete on niche differentiation rather than volume economics.

Premium Clipper Manufacturers and Industry Leaders

Wahl Clipper Corporation remains the dominant force in professional grooming equipment, commanding approximately 40% of the North American market share. Their legacy spans over 100 years, establishing deep relationships with professional barbers and salon networks. Wahl’s product portfolio ranges from entry-level trimmers priced under $50 to professional-grade cordless clippers exceeding $300. Their investment in cordless technology and ergonomic design has set industry benchmarks that competitors continuously attempt to match.

Andis Company, another heritage brand, focuses specifically on professional barbers and stylists. Their reputation for precision engineering and reliability makes them the preferred choice in high-volume salon environments. Andis maintains premium positioning through selective distribution channels, avoiding mass-market retailers that might dilute brand perception. This strategy reinforces professional positioning while maintaining stronger margins than volume-focused competitors.

Babyliss PRO has successfully captured significant market share among younger professionals and salon chains through aggressive marketing and influencer partnerships. Their cordless innovation and aesthetic design appeal to fashion-conscious barbers who view equipment as part of their professional identity. Babyliss PRO’s pricing strategy typically positions products between Wahl’s mass-market offerings and ultra-premium brands, creating accessibility for growing barbershops.

Emerging manufacturers like Barber Pole, Oster, and specialized European brands have begun capturing niche segments through superior design, sustainability positioning, or specialized features. These companies often emphasize craftsmanship, limited production runs, or proprietary technology to justify premium pricing and differentiate from established players. When evaluating specialty product companies, similar differentiation strategies apply across industries.

International manufacturers from Japan, Germany, and Italy bring precision engineering traditions to the grooming equipment market. These brands often command premium prices justified by superior build quality, longer operational lifespans, and reduced maintenance requirements. Their distribution typically concentrates in high-end salons and professional training institutions.

Technological Innovation in Grooming Equipment

Cordless technology represents the most significant recent innovation in beard trimmer design. Battery longevity has extended from 30 minutes to over 90 minutes on single charges, eliminating the primary disadvantage of cordless systems. Lithium-ion battery improvements have reduced charging times while improving temperature management during extended use. This technological advancement fundamentally altered market dynamics, as professional-grade cordless clippers now deliver performance equivalent to corded equipment while offering superior mobility and comfort.

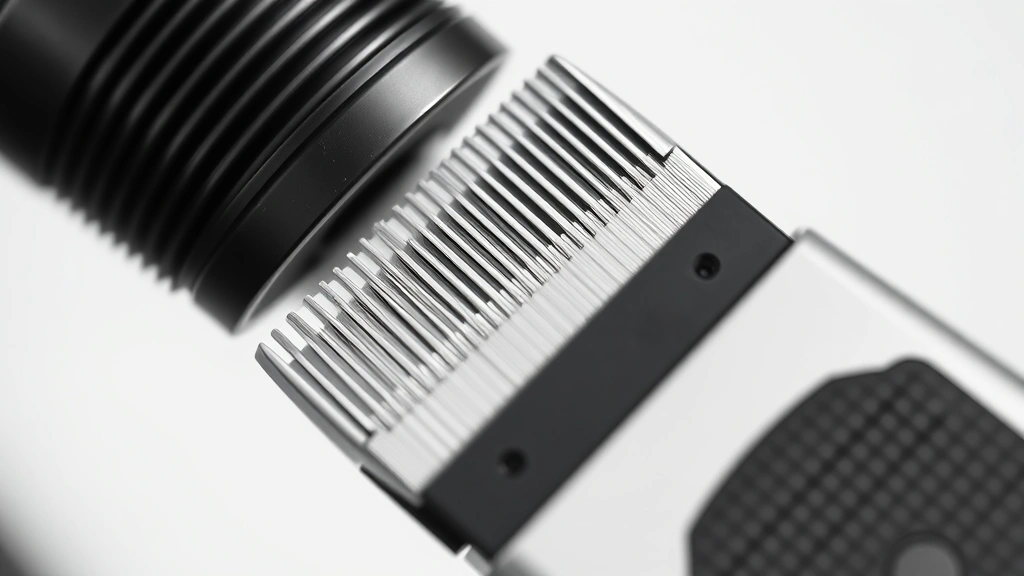

Blade technology has evolved substantially through precision manufacturing and materials science advances. Modern blades utilize ceramic-titanium composite materials that maintain sharpness longer than traditional steel while reducing heat generation during use. Hypoallergenic blade coatings minimize skin irritation for sensitive users, expanding addressable market segments. Some manufacturers now offer replaceable blade cartridges rather than complete unit replacement, reducing total cost of ownership and improving customer lifetime value.

Variable speed settings provide operators with enhanced control over cutting performance across different hair types and desired styling outcomes. Professional equipment now commonly offers 5-15 discrete speed settings, allowing barbers to optimize performance for specific applications. This feature particularly benefits shops serving diverse clientele with varying hair textures and grooming preferences.

Noise reduction technology has improved dramatically, with premium models operating at 60-65 decibels compared to 80+ decibels for older equipment. Quieter operation reduces workplace fatigue, improves customer experience, and enables longer operational sessions without auditory stress. This seemingly minor feature significantly impacts professional satisfaction and daily operational quality.

Smart connectivity features represent the frontier of grooming equipment innovation. Some manufacturers now integrate Bluetooth technology, enabling usage tracking, maintenance reminders, and performance analytics. While adoption remains limited among traditional barbers, younger professionals increasingly appreciate data-driven insights into equipment performance and maintenance schedules. This technological direction could fundamentally reshape how precision equipment companies approach customer relationships and service delivery.

Evaluating Quality and Performance Metrics

Motor power, measured in watts or RPM (revolutions per minute), directly correlates with cutting performance and equipment longevity. Professional-grade clippers typically operate at 7,000-10,000 RPM, providing sufficient power for consistent cutting through dense beard hair without motor strain. Equipment operating below 5,000 RPM often exhibits inconsistent performance and requires more frequent blade maintenance.

Heat management capability distinguishes premium equipment from budget alternatives. Motors generating excessive heat during extended use cause discomfort, reduce blade efficiency, and shorten operational lifespan. Thermal management systems in professional-grade equipment maintain consistent temperature through ventilation design and motor efficiency optimization. This feature proves critical for shops operating 8-10 hour days with minimal equipment downtime.

Blade gap precision determines cutting consistency and customer satisfaction. Professional equipment maintains blade gap tolerances within 0.1mm, ensuring uniform cutting heights across entire blade width. This precision proves particularly important for detailed work and fade techniques that define modern barbering artistry. Lower-quality equipment exhibits blade gap drift during operation, causing visible inconsistencies in finished styling.

Vibration characteristics significantly impact operator comfort during extended use. Excessive vibration causes hand fatigue, reduces cutting precision, and potentially creates repetitive strain injuries. Premium manufacturers invest in vibration dampening technology and precise motor balancing to minimize this occupational hazard. Professional barbers often test equipment extensively before purchasing, prioritizing vibration characteristics alongside cutting performance.

Forbes Business Insights notes that professional equipment reliability directly impacts salon profitability, as equipment downtime forces cancellations and customer dissatisfaction. This economic reality justifies premium pricing for dependable, well-supported equipment compared to budget alternatives requiring frequent replacement.

Corrosion resistance and durability under salon conditions represents an often-overlooked quality metric. Exposure to moisture, cleaning solutions, and frequent sanitization accelerates corrosion in lower-quality materials. Premium equipment utilizes stainless steel components and protective coatings that withstand rigorous professional salon environments for 5-10 years of continuous use.

” alt=”Professional barber using premium beard trimmer on client in modern salon setting with chrome fixtures and warm lighting”/>

Business Considerations for Equipment Retailers

Inventory management strategies differ significantly based on retail positioning and target market. High-volume retailers emphasize diverse price points and accessibility, requiring broad SKU ranges from budget to mid-premium segments. Specialty retailers focusing on professional markets typically concentrate inventory in premium segments, accepting lower volume in exchange for higher margins and stronger customer relationships.

Pricing strategy profoundly impacts market positioning and customer perception. Harvard Business Review research demonstrates that premium pricing signals quality and exclusivity, attracting professional customers willing to invest in superior equipment. Conversely, aggressive discounting attracts price-sensitive consumers but risks brand dilution and customer expectation misalignment. Successful equipment retailers carefully calibrate pricing to reinforce desired market positioning.

Vendor relationships and distributor agreements structure the economic model for equipment retailers. Exclusive distribution arrangements provide competitive advantages through differentiated product access and protected margins, though they typically require minimum purchase commitments and territorial restrictions. Non-exclusive distribution offers flexibility but intensifies price competition and commoditization pressures.

Training and technical support capabilities differentiate retailers in competitive markets. Retailers offering comprehensive staff training on product features, maintenance procedures, and troubleshooting build customer loyalty and reduce return rates. This value-added service justifies premium positioning and creates barriers to online-only competitors lacking local support infrastructure. Similar support strategies benefit companies across industries seeking to enhance customer retention.

Demonstration equipment and trial programs significantly influence professional purchasing decisions. Allowing barbers to test equipment extensively before committing to inventory purchases reduces perceived risk and accelerates adoption cycles. This approach proves particularly valuable when introducing new brands or innovative features to established professionals with ingrained preferences.

Distribution Channels and Supply Chain Strategy

Direct-to-consumer sales channels have expanded dramatically through e-commerce platforms, enabling manufacturers to capture retail margins previously retained by intermediaries. However, professional barbers often prefer purchasing through established retailers offering local support and warranty service. This channel preference creates ongoing roles for specialty distributors despite direct-sales capabilities.

Professional supply distributors maintain critical market positions by aggregating diverse product lines, providing credit terms, and offering local technical support. These intermediaries reduce friction in professional procurement by consolidating multiple vendor relationships into single ordering platforms. Their survival depends on delivering value beyond simple product availability, emphasizing service differentiation in increasingly competitive markets.

Salon chains and franchise operations typically negotiate volume discounts and exclusive arrangements with primary manufacturers. These relationships provide stability for manufacturers while enabling chains to optimize equipment specifications across multiple locations. Franchise models increasingly standardize on specific equipment brands to maintain operational consistency and service quality standards.

Online marketplaces have democratized equipment access, enabling smaller barbershops to source inventory previously available only through established distributor networks. This distribution expansion intensifies price competition while improving market efficiency. However, warranty service, technical support, and return management remain challenging in pure e-commerce models, creating opportunities for integrated retailers offering comprehensive service.

International distribution complexity increases significantly for manufacturers expanding beyond domestic markets. Different regulatory requirements, voltage standards, and professional preferences necessitate product adaptations and localized marketing strategies. Successful international expansion requires partnerships with established regional distributors possessing market knowledge and customer relationships.

Warranty, Support, and Professional Services

Warranty programs significantly influence professional purchasing decisions and total cost of ownership calculations. Premium manufacturers typically offer 2-3 year warranties covering defects and mechanical failure, while budget equipment often includes only 6-12 month coverage. Extended warranty options provide additional risk mitigation for high-volume users where equipment failure creates substantial operational disruption.

Repair and maintenance services represent critical differentiators in competitive markets. Manufacturers maintaining authorized service centers enable rapid equipment turnaround, minimizing salon downtime. Some premium brands offer loaner equipment during repairs, ensuring continuous operational capability. These service investments strengthen customer relationships while generating recurring revenue through maintenance and parts sales.

Technical support responsiveness and expertise directly impact customer satisfaction and brand loyalty. Professional barbers require immediate assistance when equipment malfunctions during operational hours. Manufacturers maintaining responsive support teams accessible via phone, email, or chat build stronger customer relationships than those providing delayed or inadequate support.

Replacement parts availability ensures equipment longevity and continued functionality. Manufacturers committing to parts availability for 7-10 years enable customers to maintain equipment investments across extended operational lifespans. This commitment proves particularly valuable for premium equipment where replacement costs justify extended repair investments.

Professional certification programs and educational resources strengthen manufacturer-customer relationships while improving equipment utilization. Manufacturers offering comprehensive training on advanced techniques, maintenance procedures, and troubleshooting create customer advocates who recommend equipment to peers and professional networks. These programs generate substantial brand loyalty beyond transactional relationships.

Community building among professional users creates valuable network effects benefiting equipment manufacturers. Online forums, regional events, and professional associations facilitate peer-to-peer learning and strengthen emotional connections to brands. Manufacturers actively participating in these communities build brand loyalty and generate valuable product feedback informing innovation investments.

FAQ

What distinguishes professional-grade beard trimmers from consumer models?

Professional-grade equipment features superior motor power (7,000-10,000 RPM), precision blade engineering, enhanced thermal management, and durable construction designed for 8-10 hour daily use. Consumer models typically operate at lower speeds, generate excessive heat during extended use, and lack the durability and support infrastructure required in professional salon environments. Professional equipment investments typically range from $150-$400, while consumer models cost $30-$100.

How important is cordless technology for beard trimmer selection?

Cordless technology has become nearly standard in professional equipment, offering superior mobility and operator comfort compared to corded alternatives. Modern lithium-ion batteries provide 60-90 minute runtime on single charges, eliminating the primary disadvantage of cordless systems. Professional barbers increasingly prefer cordless equipment for flexibility and reduced tangles during operation. However, some traditionalists maintain corded equipment preferences for consistent power delivery and simplified maintenance.

What warranty coverage should businesses expect from premium manufacturers?

Premium manufacturers typically offer 2-3 year warranties covering defects, mechanical failure, and manufacturing defects. Coverage typically excludes normal wear, damage from improper maintenance, and cosmetic damage. Extended warranty options providing additional years of coverage are available from most premium brands at reasonable costs. Professional retailers should carefully review warranty terms and support availability when evaluating equipment investments.

How frequently should professional beard trimmer equipment require maintenance?

Daily cleaning and sanitization extend equipment lifespan significantly. Professional equipment requires weekly deep cleaning, monthly blade alignment verification, and quarterly professional servicing in high-volume environments. Manufacturers provide detailed maintenance protocols and recommend specific cleaning solutions preventing corrosion and mechanical wear. Proper maintenance typically extends equipment lifespan from 5-7 years to 10+ years, substantially improving total cost of ownership.

What factors should guide equipment selection for new barbershop startups?

Bureau of Labor Statistics data indicates that equipment represents 10-15% of initial startup capital for new barbershops. New operators should prioritize reliability, professional support availability, and warranty coverage over cutting-edge features. Starting with mid-premium equipment from established manufacturers (Wahl, Andis, Babyliss PRO) provides optimal balance between investment costs and operational capability. As businesses mature, upgrading to ultra-premium equipment becomes economically justified through increased volume and profitability. Consulting established retailers and professional networks provides valuable guidance for startup equipment decisions, similar to evaluating other specialized business equipment purchases.

How do beard equipment companies differentiate in increasingly competitive markets?

Successful differentiation strategies emphasize specialized features, premium materials, exceptional support, and community building. Some manufacturers focus on sustainability through recyclable materials and environmentally conscious manufacturing. Others emphasize design aesthetics and professional positioning through selective distribution and influencer partnerships. Emerging companies often compete through innovation in battery technology, noise reduction, or ergonomic design. Understanding target market priorities and building authentic brand positioning around those priorities proves essential for differentiation in crowded markets. Similar strategies benefit companies across industries seeking competitive advantages.