Top Wrestling Companies: Industry Overview and Market Analysis

The professional wrestling industry has evolved into a multibillion-dollar global entertainment sector, far transcending its origins as a carnival attraction. Today’s wrestling companies operate as sophisticated media enterprises, generating revenue through live events, broadcasting rights, merchandise, and digital streaming platforms. Understanding the landscape of major wrestling organizations provides valuable insights into sports entertainment business models, audience engagement strategies, and the competitive dynamics shaping modern entertainment.

The wrestling industry encompasses diverse organizational structures, from publicly traded corporations to privately held ventures, each employing distinct operational strategies and monetization approaches. These companies have demonstrated remarkable resilience and adaptability, particularly through digital transformation initiatives that have expanded their reach beyond traditional television audiences. Examining the top wrestling companies reveals critical lessons in brand management, content creation, and stakeholder value creation.

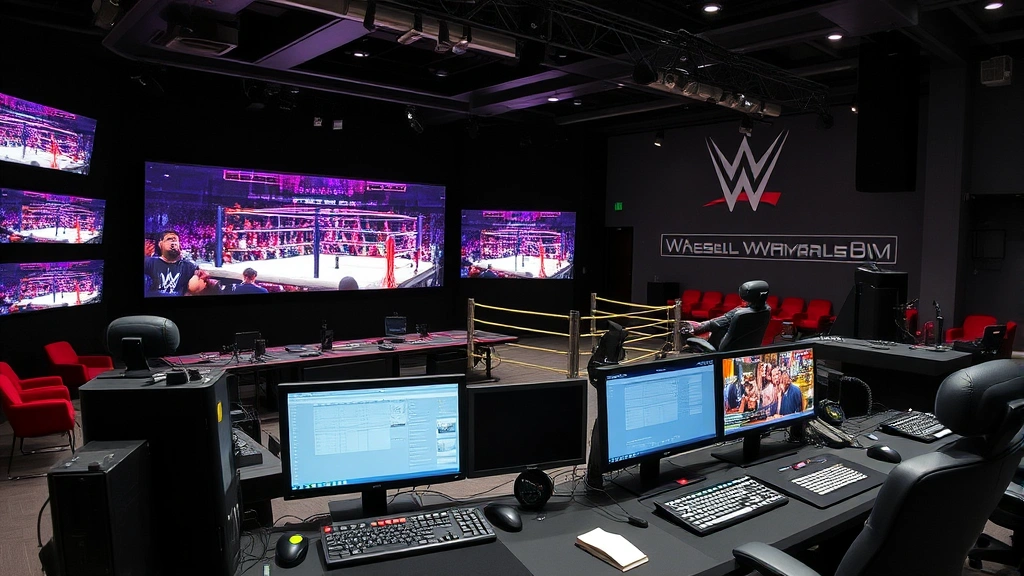

WWE: Market Dominance and Corporate Evolution

World Wrestling Entertainment (WWE) stands as the undisputed heavyweight champion of the professional wrestling industry, commanding approximately 80% of the global wrestling market share. The organization’s trajectory from a regional promotion to a publicly traded entertainment conglomerate represents one of the most successful business transformations in sports history. WWE’s market capitalization has fluctuated significantly, reflecting both the volatile nature of entertainment stocks and the company’s strategic pivots.

WWE’s business model centers on content creation and intellectual property exploitation across multiple platforms. The company generates revenue through five primary channels: live event ticket sales, broadcast and streaming rights, merchandise licensing, sponsorships, and talent-related services. The organization’s acquisition by Endeavor Group Holdings in 2022 for approximately $5.5 billion (including WCW and ECW intellectual property) marked a significant consolidation moment, creating a unified entertainment powerhouse.

The company’s strategic infrastructure includes elaborate business partnership agreements with networks, streaming platforms, and sponsors. WWE’s partnership with Netflix for international streaming rights demonstrates sophisticated media negotiation capabilities. The organization’s publicly disclosed financial metrics reveal consistent revenue generation, with annual revenues exceeding $1 billion, though profitability metrics have faced pressure from increased talent expenditures and production costs.

WWE’s operational structure emphasizes content consistency and brand standardization across global markets. The company operates distinct brand divisions (Raw, SmackDown, NXT, and international territories), each with dedicated production teams, creative departments, and talent rosters. This organizational design facilitates content diversification while maintaining centralized quality control and strategic oversight.

AEW: The Challenger Brand Strategy

All Elite Wrestling (AEW) emerged in 2019 as a significant competitive challenger to WWE’s market dominance, funded by billionaire entrepreneur Tony Khan. The organization’s entry disrupted the wrestling industry’s competitive landscape, forcing WWE to reassess talent retention strategies and creative programming. AEW’s business model emphasizes wrestler creative control, fan-centric storytelling, and competitive television programming against WWE’s offerings.

AEW’s revenue model differs substantially from WWE’s diversified approach. The organization relies heavily on television broadcast rights (Warner Bros. Discovery’s TNT and TBS networks), supplemented by pay-per-view events, live gate receipts, and merchandise. The company’s financial performance has been scrutinized by investors, with reported losses in early operational years as the organization invested heavily in talent acquisition and production quality. However, strategic cost management and improved broadcast negotiations have enhanced profitability trajectories.

The challenger brand approach has yielded competitive advantages in specific demographics and critical acclaim. AEW’s programming attracts younger audiences and wrestling traditionalists, creating distinct market segmentation. The organization’s relationship with TBS represents a significant revenue anchor, though the broadcasting landscape’s evolution continues to present both opportunities and challenges. AEW’s emphasis on innovation in match presentation and storytelling has influenced WWE’s creative direction, demonstrating competitive pressure effects within the industry.

International Wrestling Powerhouses

Global wrestling markets extend far beyond North American entertainment, with significant operations in Mexico, Japan, India, and Europe. New Japan Pro Wrestling (NJPW) operates as Japan’s premier wrestling organization, emphasizing athletic presentation and strong style wrestling that appeals to dedicated fan communities. NJPW’s business model incorporates pay-per-view events, broadcast partnerships, and extensive merchandise operations, generating substantial revenue from dedicated Japanese audiences.

Mexico’s Lucha Libre organizations, particularly Consejo Mundial de Lucha Libre (CMLL) and Lucha Libre AAA Worldwide, operate with distinct cultural contexts emphasizing mask traditions and acrobatic wrestling styles. These organizations maintain strong regional revenue bases while increasingly pursuing international distribution through streaming platforms and content licensing agreements. The cultural significance of lucha libre creates strong audience loyalty and merchandise opportunities.

India’s wrestling market has experienced explosive growth through WWE’s localized programming and emerging indigenous wrestling promotions. The Indian subcontinent represents one of wrestling’s fastest-growing markets, driven by increasing digital penetration and cultural enthusiasm for physical competition. European wrestling organizations maintain regional strongholds through established fan bases and touring circuits, though consolidation pressures continue to reshape the competitive landscape.

These international organizations frequently engage in talent exchange agreements and cross-promotional partnerships, creating global entertainment networks. Such arrangements provide talent mobility, audience expansion opportunities, and revenue diversification for participating organizations.

Revenue Models and Monetization Strategies

Wrestling companies employ sophisticated revenue diversification strategies that extend well beyond live event gate receipts. Modern wrestling enterprises function as integrated media companies, monetizing content across multiple distribution channels and consumer touchpoints. Understanding these revenue models reveals critical insights into contemporary entertainment business architecture.

Live Event Revenue: Wrestling companies generate significant income through ticket sales for televised events and non-televised house shows. Premium events command substantially higher ticket prices, with championship-level programming attracting audiences willing to pay premium rates. Venue selection, talent quality, and storytelling momentum directly influence attendance and per-ticket revenue realization.

Broadcast and Streaming Rights: Television broadcast agreements represent the largest revenue component for major wrestling organizations. Negotiations with networks involve complex calculations regarding audience demographics, time slot value, and content exclusivity. Streaming platforms have introduced new revenue opportunities, with companies negotiating separate international distribution rights and premium content tiers.

Merchandise and Intellectual Property: Wrestling companies generate substantial revenue through merchandise licensing, including apparel, collectibles, and digital products. Intellectual property exploitation extends to video game licensing, action figures, and entertainment media rights. The merchandising business benefits from passionate fan communities willing to purchase extensive product assortments.

Sponsorship and Advertising: Corporate partnerships provide significant revenue streams through arena sponsorships, product placement within programming, and exclusive category partnerships. Sponsorship negotiations reflect audience demographics and brand alignment opportunities, with technology, energy drink, and consumer goods companies frequently engaging wrestling properties.

Premium Content and Fan Engagement: Direct-to-consumer revenue through premium subscription services, fan clubs, and exclusive content represents an emerging revenue category. Organizations increasingly develop proprietary platforms and membership programs that create recurring revenue streams while strengthening audience relationships.

Digital Transformation and Streaming

Digital transformation has fundamentally reshaped wrestling industry economics and audience engagement models. Streaming platforms have disrupted traditional television broadcasting, creating new distribution channels while simultaneously reducing traditional television revenue. Wrestling companies have adapted through strategic platform partnerships and proprietary content development.

WWE’s investment in WWE Network (now integrated into Peacock) demonstrates first-mover advantages in direct-to-consumer streaming. The platform provides archive content access, live event streaming, and original programming, creating recurring subscription revenue. This vertical integration reduces dependency on traditional broadcasters while creating direct consumer relationships that facilitate data collection and personalized marketing.

Digital marketing strategies have become essential for wrestling companies seeking to maintain audience engagement and attract new viewers. Social media platforms, YouTube channels, and TikTok presence extend content reach and facilitate fan community building. Influencer partnerships and content creator collaborations generate authentic audience engagement beyond traditional marketing approaches.

The streaming landscape’s evolution continues to present challenges and opportunities. Changing consumer preferences toward on-demand content consumption has accelerated cord-cutting trends, reducing traditional television audiences. However, wrestling’s live event nature creates compelling streaming content, as audiences value real-time consumption of unpredictable live outcomes.

Talent Management and Partnership Agreements

Talent represents wrestling companies’ most valuable asset, with performer compensation consuming significant operational budgets. Modern wrestling organizations employ complex compensation structures combining guaranteed salaries, event bonuses, merchandise participation, and media rights revenue sharing. Talent partnership agreements establish critical frameworks governing intellectual property rights, exclusivity provisions, and revenue participation.

The independent contractor classification debate has intensified within wrestling industries, with talent advocates pushing for employee status and associated benefits. Major wrestling organizations have resisted reclassification, maintaining contractor status that provides operational flexibility and cost management advantages. This evolving labor landscape presents significant legal and financial implications for wrestling companies.

Talent acquisition strategies reflect competitive market dynamics, with organizations competing aggressively for marquee performers capable of driving audience engagement. Free agency periods generate substantial media attention and financial commitments, as organizations invest heavily in talent signings expected to generate revenue multiples through increased attendance and broadcast viewership.

International talent recruitment has become increasingly important as wrestling organizations pursue global audience expansion. Visa sponsorship, relocation support, and international compensation structures facilitate talent mobility while creating operational complexities. These arrangements require sophisticated human resources management and legal compliance expertise.

Risk Management in Wrestling Operations

Wrestling companies face distinct operational risks requiring sophisticated management frameworks. Performer injuries, broadcast rights negotiations, talent retention, and regulatory compliance present multifaceted risk exposure. Risk management frameworks addressing these challenges are essential for organizational resilience and stakeholder protection.

Health and Safety Risks: Wrestling’s physical nature creates inherent injury risks affecting performer availability and organizational liability. Modern organizations implement comprehensive medical protocols, performer wellness programs, and insurance coverage addressing injury-related contingencies. However, catastrophic injury risks remain difficult to fully mitigate, requiring robust insurance arrangements and legal protection strategies.

Broadcast and Regulatory Risks: Regulatory compliance with broadcasting standards, content guidelines, and talent classification requirements presents ongoing compliance obligations. Changes in regulatory frameworks or broadcasting standards can significantly impact content creation and operational costs. Organizations must maintain legal expertise addressing evolving regulatory landscapes.

Financial and Market Risks: Wrestling companies face market volatility affecting advertising revenue, broadcast rights negotiations, and consumer spending patterns. Economic downturns can reduce both live event attendance and discretionary spending on merchandise and premium content. Business sustainability strategies incorporating financial resilience and diversification mitigate these cyclical risks.

Reputational Risks: Talent conduct, organizational scandals, and creative missteps can damage brand reputation and audience trust. Social media amplification of controversies requires rapid response capabilities and crisis management expertise. Organizations must implement governance structures ensuring ethical conduct and organizational accountability.

Competitive and Strategic Risks: Industry consolidation and competitive pressures create ongoing strategic challenges. Business exit strategies and long-term positioning require careful analysis of competitive dynamics and market evolution. Organizations must continuously assess strategic positioning relative to competitor initiatives and emerging market opportunities.

Industry Financial Performance and Investment Outlook

The professional wrestling industry has demonstrated consistent financial growth despite competitive pressures and market disruptions. According to McKinsey analysis of entertainment sector dynamics, wrestling properties command premium valuations reflecting loyal audience bases and recurring revenue models. Industry analysts project continued growth driven by digital expansion, international market development, and innovative content formats.

WWE’s public financial disclosures reveal revenue resilience, with consistent year-over-year growth despite competitive challenges from AEW. The organization’s acquisition by Endeavor Group provides access to capital resources supporting continued investment in content quality and technology infrastructure. However, profitability metrics have faced pressure from elevated talent expenditures and production costs.

AEW’s financial trajectory demonstrates the investment requirements for establishing competitive wrestling operations. The organization’s journey from substantial losses to approaching profitability illustrates the challenging economics of challenging market incumbents. Continued improvement in broadcast ratings and cost management will determine long-term viability and competitive sustainability.

Industry consolidation trends suggest potential future mergers and acquisitions, as larger entertainment corporations recognize wrestling properties’ strategic value. The sector’s demonstrated audience loyalty and content monetization capabilities attract investor interest, supporting continued capital availability for growth initiatives.

FAQ

What is the largest wrestling company globally?

WWE remains the largest wrestling company, commanding approximately 80% of the global professional wrestling market. The organization’s diversified revenue model, established broadcast partnerships, and extensive talent roster maintain significant competitive advantages. WWE’s acquisition by Endeavor Group in 2022 further solidified its market position and provided access to additional capital resources.

How do wrestling companies generate revenue?

Wrestling companies employ diversified revenue models including live event ticket sales, broadcast and streaming rights, merchandise licensing, sponsorship agreements, and premium content subscriptions. Major organizations derive the largest revenue percentages from broadcast rights agreements, supplemented by other revenue streams creating financial stability and growth opportunities.

What are the main competitive challenges in wrestling?

Primary competitive challenges include talent acquisition and retention costs, broadcast rights negotiation complexities, audience fragmentation across platforms, regulatory compliance requirements, and competitive pressures from emerging organizations. Organizations must continuously adapt creative programming and operational strategies to maintain audience engagement and financial performance.

How has streaming affected wrestling companies?

Streaming platforms have fundamentally disrupted traditional television distribution while creating new revenue opportunities. Wrestling companies have adapted through direct-to-consumer streaming services, exclusive platform partnerships, and social media engagement strategies. While traditional television audiences have declined, streaming adoption has expanded overall audience reach and created new monetization opportunities.

What role do international markets play in wrestling?

International markets represent significant growth opportunities and revenue sources for wrestling companies. Japan, Mexico, India, and Europe maintain established wrestling cultures with dedicated audiences. Organizations increasingly pursue international expansion through broadcast partnerships, talent recruitment, and localized content development strategies.

Are wrestling performers considered employees or contractors?

Major wrestling organizations currently classify performers as independent contractors, providing operational flexibility and cost management advantages. However, labor classification debates continue, with talent advocates pushing for employee status and associated benefits. This evolving landscape may significantly impact wrestling company operational structures and compensation models.

What is the future outlook for wrestling companies?

Industry analysts project continued growth driven by digital expansion, international market development, and innovative content formats. Wrestling properties command premium valuations reflecting loyal audiences and recurring revenue models. However, organizations must navigate competitive pressures, regulatory changes, and evolving consumer preferences to maintain long-term growth trajectories.